Blockchain technology is expected to revolutionize the domain of finance in a big way. Cryptocurrencies have already made deep inroads in many countries because of the ease of settlement. In India, the Central Bank (RBI) has been watching this development and expressed concern about unregulated cryptocurrencies that are doing the rounds. In February 2021, the RBI Governor, Shaktikanta Das, emphasized the need for monitoring and regulating cryptocurrencies and hinted that India may soon come out with its private blockchain platform to usher in the much-awaited ‘Digital Currency’. Although it would be no different from other forms of cryptocurrency in terms of technology, it would be quite different in terms of the regulatory framework. Since this visible money is as good as cash, it is likely to do away with intermediaries and use the UPI (Unified Payments Interface) for quick hops. The deep penetration of the internet in both urban and rural India is most likely to provide a great launchpad for this new initiative. The ever-increasing use of smartphones with data may ensure ease of access and widespread acceptability among all sections of the population. Concerted efforts to strengthen the rural digital infrastructure and widespread use of UPI are expected to facilitate digital currency circulation in a big way.

Complaints about manipulations in cryptocurrency in other parts of the world have rendered India’s approach to bringing in digital currency with a great amount of caution.

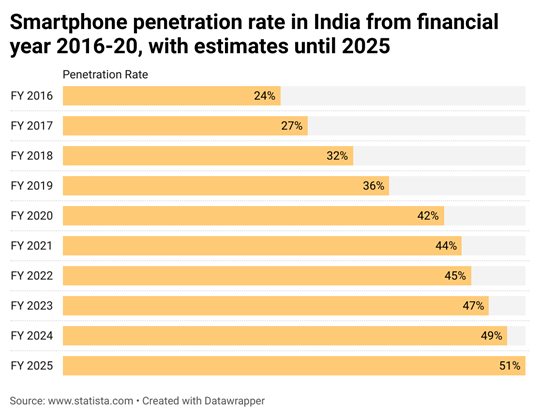

Internet and smartphone penetration in India

With the kind of market size and potential India has, the country has raised the contour among the upcoming technologically advanced countries. India has been among the top two countries in terms of digital adoption on many key dimensions. It is at a first position in the world in enrolling 1.2 billion people for unique digital identity program, and at second position behind China in terms of app downloads, subscribers with wireless phones, internet subscribers, smartphone devices, and users engaged in social media. Two major reasons for such a pace of adoption in India are the internet and smartphone penetration. This has been possible because of combined influences by the public and private sectors.

Steps like rapid work-up on Aadhaar, promotion of digital payments through the launch of Pradhan Mantri Jan-Dhan Yojana (with total balance at Rs 1.4-Lakh Crore), etc., have been some efforts coming from the public sector to boost digitization in India. Constant competition in the private sector has helped bring down digital costs and scaling operations with magnified usage. According to McKinsey research, India has reduced data costs by 95% from 2013 to 2019, with an internet user base of around 560 million subscribers. It has removed the cost barrier in adopting the digital revolution in the country. India is also to have 820 million smartphone users by 2022 (according to Indian Cellular and Electronics Association (ICEA) in partnership with KPMG India), making the country the second-largest smartphone market by volume. It also leads us to the positive outlook of India leveraging with the new industrial revolution 4.0.

Government initiatives

With the ongoing global trend of adapting digital currency as a mode of transaction and momentum the country has seen in the digital space, the central bank is also exploring the Distributed Ledger Technology (DLT) to find out solutions in implementing Central Bank Digital Currency (CBDC). According to a recent survey of the Bank for International Settlements, it was found that 80 percent of 66 responding central banks have started exploring in the same line for potential benefits to the economy.

The RBI is concerned over cryptocurrencies as they can be used for illegal activities. Cryptocurrencies are next to impossible in terms of tracking. They are highly volatile and hence creates instability in the financial system and are not backed by gold or any commodity which makes it incapable of serving as fiat currency. Although blockchain technology has advantages and usage in a wide gamut of services, it also suffers from rigidity and the inability to make changes in documents uploaded into the platform. Pros like increased transparency, accurate tracking, cheaper alternative, and permanent record maintenance make it capable of being used in supply chain management, healthcare, real estate, media, and many more. But being in its infancy, it faces challenges of regulatory implications, implementation, and complexity in technology. Hence a coordinated effort could be adopted by consulting various stakeholders like financial institutions, fintech players, etc., to ensure that practical perspectives get addressed. It will help India to transform into a digitally empowered society and knowledge economy.

In the light of the above insights, the country cannot afford to be left behind as far as blockchain technology is concerned.

Let us look at the positive side of digital money both in terms of ease of settlement and transaction costs. Primarily the t+2 day’s settlement period in financial markets is viewed as a great disadvantage to the investor. It is quite possible to narrow this period down to t+2 hours by doing away with multiple intermediaries in the supply chain, thus effectively bringing down transaction costs as well.

Progress is the exchange of one form of a nuisance for another, but that does not prevent us from progressing. The critical aspects of information security upgraded technology, and seamless migration to digital currency all need to be capital-evaluated before embarking upon this initiative. The path-breaking endeavour may well be the answer to eradicate some undesirable practices associated with paper currency and hot money. “The journey to a thousand mile begins with a single step”, and digital money may well be the confident first step by RBI with a regulatory framework for suitable checks and balances.

Dr. Nusrathunnisa

Assistant Professor

Area of Finance

Alliance School of Business

Alliance University

Sources:

- MGI-Digital-India-Report-April-2019.pdf (mckinsey.com)

- India to get 829 million smartphone users by 2022, says ICEA | HTTech (hindustantimes.com)

- RBI plans and an upcoming Bill: Where are digital currencies headed? | Explained News, The Indian Express

- The growing list of applications and use cases of blockchain technology in business and life | Business Insider India

- Making sense of bitcoin and blockchain: PwC

- How likely is a digital rupee? | Technology News, The Indian Express